Chris ZEE. Head of Equity Advisory, Asia, BNP Paribas Wealth Management & Godfrey OYENIRAN, Senior Adviser, Equity Advisory Asia, BNP Paribas Wealth Management

European investors ignored an unstable economic backdrop to lift the Stoxx Europe 600 to the highest levels since February 2022. The broadening of an equity rally beyond US technology has been playing out in a region that has a more cyclical bias.

Sceptics may point to a mismatch between what is happening in Europe’s growth picture and how well its stocks have performed. The comparative strength in US economic growth, as reflected in its Q3 2023 gross domestic product (GDP) growth of 5.2% (while the eurozone economy contracted by 0.1% in Q3 2023), does suggest an uncomfortable truth: Europe is falling behind. With the recent batch of data showing momentum has evaporated, recessionary concerns have returned. However, as is often the case, the stock market is not the economy.

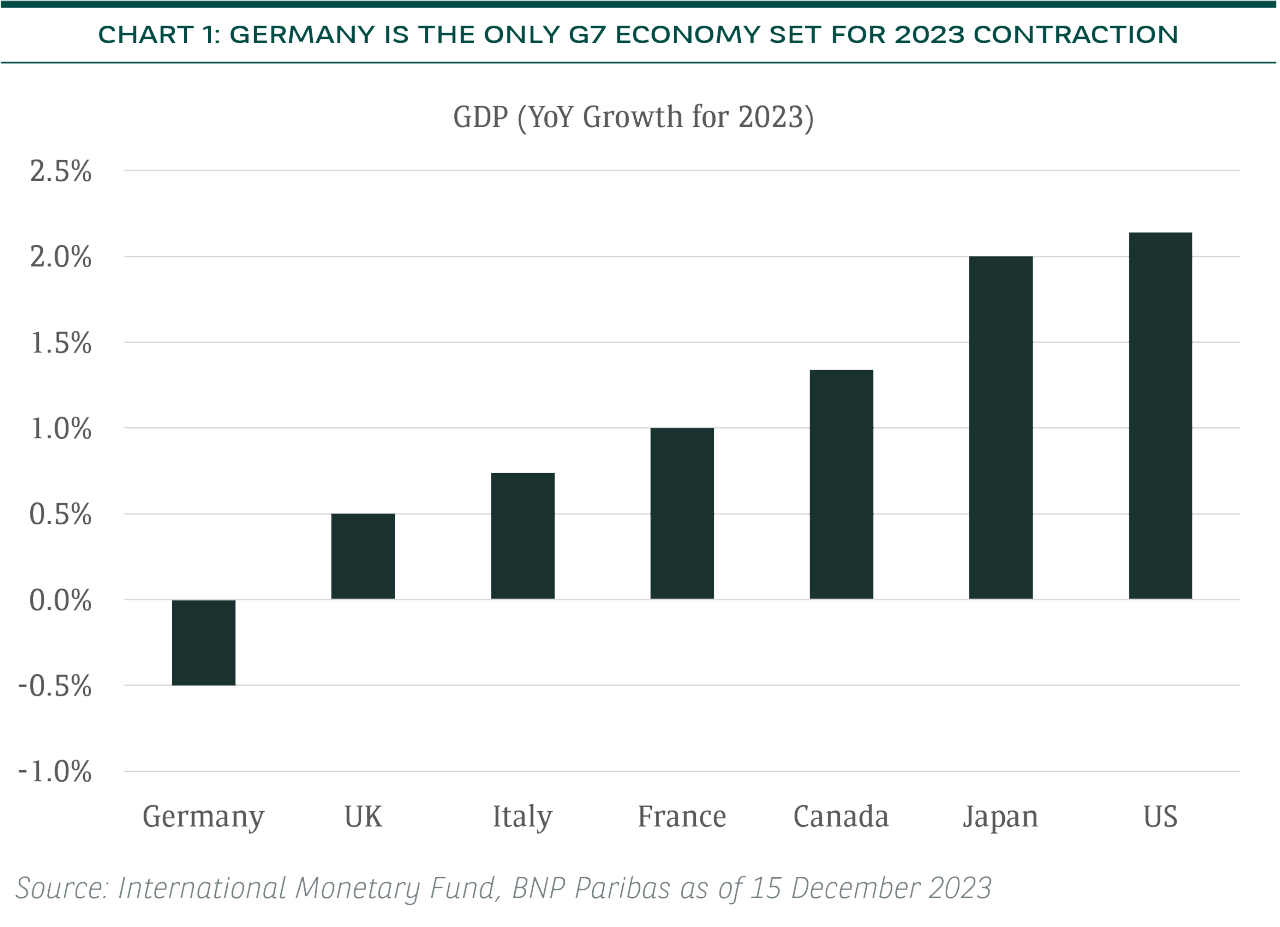

Germany, the region’s biggest engine of growth, has been a notable struggler and is the only G7 economy set for a 2023 contraction according to the International Monetary Fund (IMF) (see Chart 1). However, embracing the mood, the DAX Index closed at an all-time high in December 2023. Outperformance in cyclicals helped, given the heavy concentration in autos, industrials and chemicals. Economic prospects may look subdued, but investors have found enough to get excited about, including signs that the business outlook is improving and inflation slowing.

Recent quarterly earnings in Europe suggests a gulf with the US. For Stoxx Europe 600 companies, only 38% beat estimates with earnings per share (EPS) falling 13% year-on-year. That compares with the S&P 500 where 81% of companies beat expectations with an average EPS growth of 4.5%. With margins tending to be procyclical, Europe’s slowing economy is preventing companies from expanding them. However, again, this has not been a pushback for market performance.

The inflation story has been key, and investors will continue to monitor progress as well as corresponding monetary policy in 2024. The eurozone’s November 2023 consumer price index (CPI) reading came in at 2.4%, down from 2.9% the previous month and below 2.7% expectations. The figure is now closer to the 2% European Central Bank (ECB) target, providing more room for the bank to consider an end to hiking, supportive for pro-cyclical markets across the region.

True, the ECB has not embraced the “Fed pivot” attitude, indicating at its December 2023 meeting that it is too early to declare victory on inflation. However, that has not stopped money markets from pricing in 150 basis points of rate cuts by the ECB in 2024.

Earnings still matter

There’s also reason to assume the earnings growth path going into 2024 is still supportive. 2024 EPS estimates for the Euro Stoxx 50, for example, have risen from EUR322 in February 2023 to EUR362 on 14 December 2023. Earnings growth is expected to be led by industrials, healthcare and materials.

Strong year-end performance – now what?

The 2023 year-end rally has been welcome, particularly for a market that stagnated following the US and European banking crises in spring 2023 while early-year market leadership also disappeared. For example, high-flying luxury goods names have pulled back in the face of an end to the pandemic-era demand windfall and pricing normalisation.

2024 is likely to be a year when investors reward resilience in the face of macro challenges that could make it tough for relative gains to hold up.

As the recent surprise victory of far-right leader Geert Wilders in the Dutch elections indicated, politics may also play a part in market performance. The election result led to modest gains in real estate stocks, as the win might lead to weaker environmental regulations, while banks and clean energy firms declined. As such, the European Parliament elections in June 2024 will play an important role in formulating policies, legislation, and the overall direction of the EU, potentially shaping market sentiment.

We believe depressed valuations and dividend yield characteristics should provide support in what could be a volatile year, particularly if current rate cut expectations are too aggressive. These should give investors more of a cushion if conditions do become more taxing, with Europe trading near a record discount to the S&P 500.

UK: Moving into 2024 in slow motion

The UK’s “stagnation nation” label does the governing Conservative Party no favours as it heads into a likely general election year. The term could also apply to stock market performance that has trailed in 2023.

Growth is challenged, but there are signs of life

The UK failed to grow in the third quarter of 2023, reflecting the impact of a succession of interest rate rises. Forecasts suggest the economy is set to be stagnant for several months yet1, while The Bank of England (BOE) said the UK is likely to see zero growth until 2025, although it is expected to avoid a recession1.

The domestic picture remains mixed, as the Confederation of British Industry cautioned that retailers expect a disappointing festive season1. Rolling train strikes in December 2023 also comes at the most crucial time of year for consumer-facing businesses in city and town centres. Though, a GfK survey found that consumers are becoming more optimistic about their personal finances1. A further boost to confidence came in December 2023 after Chancellor Jeremy Hunt announced tax cuts.

Slowing inflation has been supportive

UK inflation fell sharply in October 2023 to its lowest rate in two years, largely due to lower energy prices, dropping to 4.6%, down from 6.7% the month before. Such has been the market’s sensitivity to the inflation picture, the data helped drive the FTSE 250 to its biggest two-day gain since the Covid vaccine breakthrough in November 2020, spurred on by rate-sensitive sectors like real estate. The fact that the BOE stated at its December 2023 meeting “there is still some way to go” in the fight to contain consumer prices, rate cuts are not yet on the agenda.

The market hasn’t been positioned for a rally

Although the UK market has rallied since the lows of October 2023, throughout 2023, it has lagged the broader European market that has benefited from stronger earnings and heavier exposure to growth sectors. Even Germany with its own economic issues has seen a 20.3% year-to-date return on the DAX Index (23.5% in dollar terms) as of 14 December 2023 versus the FTSE 100’s 2.7% return (8.4% in dollar terms). The UK has been hit by commodity prices being far below last year’s peak, weighing on energy and mining earnings. Financials have also reversed course on interest margin pressure.

Still a role to play in 2024

After suffering Europe’s worst earnings performance in 2023, trending toward a 9% contraction driven by energy and materials, the hope is for a rebound in profitability and UK markets in 2024.

Valuation remains a core part of the narrative. The market currently trades near the bottom of its 30-year range based on price/earnings (P/E) and price/book (P/B) ratios. Relative to other markets, it is also still priced favourably. Its P/E of 10.9x compares to 18.1x for the MSCI World Index, while its P/B is 0.8x, versus 2.9x for the MSCI World Index.

Crucially, the UK is a low beta market with a high dividend yield (the FTSE 100 yields 4%, compared with the S&P 500’s 1.5% and Stoxx Europe 600’s 3.3%), and unlike many other markets, the UK is not priced for perfection. A “perfect soft landing” may be required to justify the outperformance of certain peers. As such, in a slowing macro environment, investors should consider positioning themselves for potential risk-off periods in 2024.

1. Source: Bloomberg, as of 11 December 2023