Chris ZEE, Head of Equity Advisory, Asia; Godfrey OYENIRAN, Senior Adviser, Equity Advisory Asia;

Camilia GOH, Senior Adviser, Equity Advisory Asia; Jason LIM, Adviser, Equity Advisory Asia

Latest Fed pivot towards a potential 75 basis points rate cut in 2024 should further support US equities near term

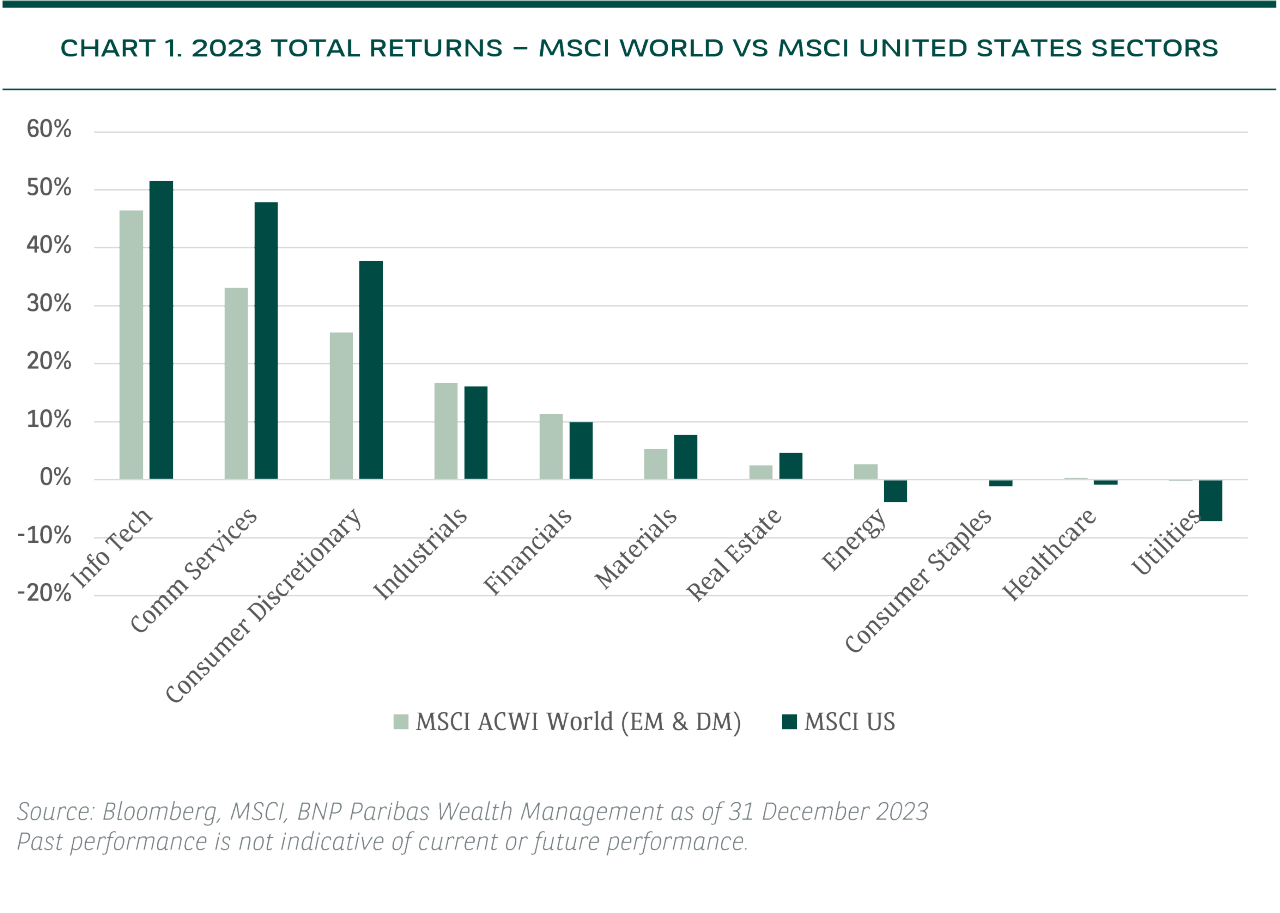

US equities closed 2023 as a strong outperformer over global equities (see Chart 1). Following the equity market consolidation in October 2023 on growth concerns from a scenario of higher-for-longer interest rates, November and December 2023 saw a reversal of the market’s earlier caution as economic data releases affirmed a goldilocks scenario where releases were resilient enough to support soft landing hopes but weak enough to limit potential rate hikes by the Federal Reserve (Fed). The Fed’s pivot in its last policy meeting on 13 December 2023 further added to the bullish market sentiment in equities, with revised dot plot forecasts indicating a series of interest rate cuts expected in 2024. The 2023 fourth quarter rally also saw a broadening of investor flows beyond tech to other sectors, which partially mitigated prior investor concerns over the narrow concentration of winners led by the Magnificent Seven stocks, which had reached concentration levels not seen since 1970s.

2024 outlook looks mixed

As we move into 2024, we continue to expect some remaining legs in the current equity market rally supported by looser financial conditions and expectations of the start of the Fed’s rate cutting cycle, although much of the short exposure appears to have been covered. From a valuation perspective, the S&P 500 index last trades at 19x forward price/earnings ratio1, which is close to +1 standard deviation to its past 10-year historical average multiple. While valuations of the equity market may stay extended for the near term, we believe there could be bouts of volatility and potential correction further down the road should expectations for inflation and growth in the US soften, while election uncertainties with increased news-flow from spring 2024 could also add volatility in sectors that are relatively more sensitive to potential policy changes.

Earnings momentum will be key

For 2024, our house forecasts a more modest pace of US gross domestic product (GDP) growth of 0.7%, versus 2.4% expected for 2023, though consumer price index (CPI) inflation is expected to ease from 4.2% in 2023 to 2.4% in 2024. Our base case scenario is for the US economy to see a mild slowdown in 1H242, which should still be largely supportive of corporate earnings, although current consensus forecasts of ~11% for 2024E3 appear fairly optimistic (versus 1.9% for 2023E3), which may see risks of moderation depending on the extent of the economic slowdown in 1H242. Given a more limited broad index growth outlook, we expect more rotational flows within the market, which suggests the need to be more selective in stock picking in 2024. Key themes which drive our stock picks focus on quality and relative earnings resilience, with ideas that should benefit from multi-year growth themes such as monetisation of generative artificial intelligence (AI) development, reshoring trends in a multi-polar world and increasing demand for wellness and obesity management.

Potential for a year of two halves

The outlook for US equities ahead should hinge on the extent of economic moderation that is likely to become clearer over the course of 2024. Our current expectation is for the Fed to cut policy rates in June 2024, with a modest recession and mild increase in the US unemployment rate, which could translate to more limited headwinds for corporate earnings.

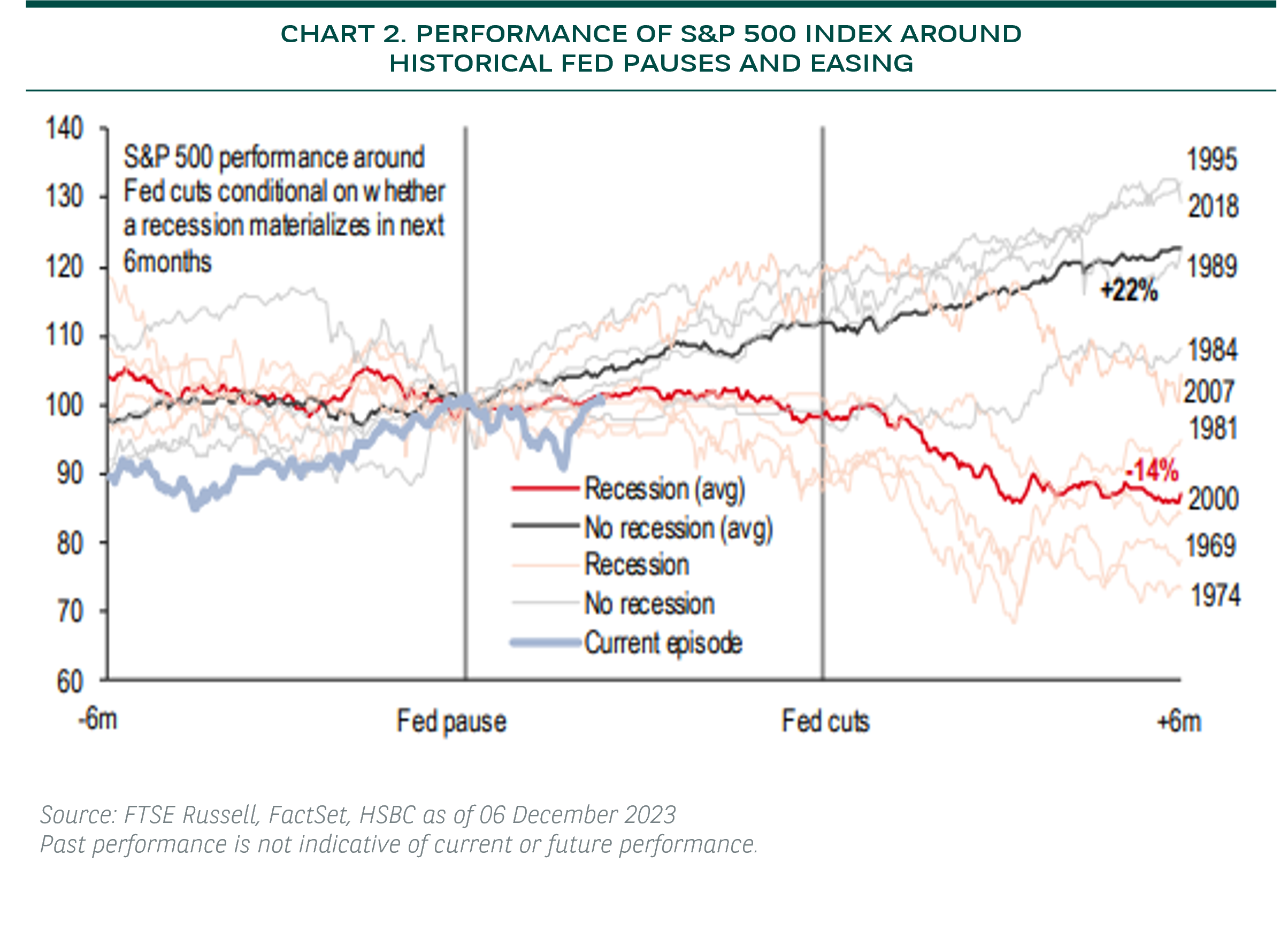

As observed by our CIO team, US stocks had historically rallied close to 13% in the six months after a Fed pause, while bear market corrections have typically begun close to a month following the first Fed rate cut (see Chart 2). While history is not indicative of future returns, this suggests that investors should remain invested for now although we would keep an eye for potential spike in market uncertainties going into 2H244.

The above backdrop is likely to provide both tactical and accumulation opportunities for fresh positions. Sectors wise, we maintain a neutral stance on most equity sectors and overweight in energy, materials and healthcare, which should add more defensiveness to investor portfolios. In terms of investment implications, it would be prudent to pay attention to core asset allocation and the diversification of portfolio holdings.

Election uncertainties could increase volatility for sectors sensitive to policy changes

Although the US presidential election is only taking place at the end of 2024, we expect increasing investor attention which could come as early as second quarter of 2024 after both nominees are firmed up and national parties have formulated their key policy platforms.

This should translate to volatility for sectors that are likely to be more sensitive to policy changes, although we note that structural constraints in Congress could result in meaningful edits to legislative proposals prior to their passage. At the same time, we believe that investors will need to keep a lookout for potential changes to existing policies depending on the outcome of the election. Areas on our radar include AI regulation, energy permits, trade and tax policies.

Current indications, while early, suggest that it could be a close election race. Indicators such as inflation trends, President Biden’s approval ratings and opinion polls are likely to be of interest to the market in 2024, with potential deceleration in inflation likely to provide an upside for the Democrats, while weaker-than-expected economic data could increase expectations for a divided government or increase the odds for a Republican win.