Investors are comparing the success of leading weight-loss drug makers to artificial intelligence chip makers. The more than doubling of the share price of leading companies Eli Lilly and Novo Nordisk in the last two years has captured investors interest in weight-loss innovations.

What are the elements driving this theme?

Obesity is a growing global epidemic, directly linked to numerous cardiovascular conditions, driving unprecedented demand for innovative treatments. Associated with it, Glucagon-like peptide or “GLP-1” is a class of drugs initially developed for diabetes, which has shown remarkable efficacy in weight management and cardiovascular risk reduction, making it a game-changer in healthcare.

- Rising obesity rates: a global epidemic

- Over 650 million adults worldwide are classified as obese, a number that has nearly tripled since 1975. In the US alone, obesity affects over 42% of the adult population.

- Obesity is a leading risk factor for cardiovascular diseases, which are the world’s number one cause of death, accounting for over 17 million deaths annually.

- Cardiovascular health: a growing concern with an aging population

- As the global population ages, the incidence of cardiovascular diseases is expected to rise sharply. By 2050, it is projected that the population aged 60 years and older will total 2.1 billion, up from 1 billion in 2020.

- Older adults are at a higher risk of developing heart diseases, particularly when compounded by obesity. This trend is driving an urgent need for innovative treatments that address both obesity and cardiovascular health.

- GLP-1: a game-changer in obesity and cardiovascular treatment

- GLP-1 receptor agonists, initially developed for diabetes management, have shown unprecedented efficacy in promoting weight loss and reducing cardiovascular risks. Recent studies have demonstrated that these drugs can lead to weight loss of up to 15% in patients, significantly lowering their risk of heart disease.

- A study from MarketWatch, from February 2024 suggests the GLP-1 market could experience annual growth exceeding 20% by 2030.

- Investment potential: a perfect storm of demand

- Analyst estimated the market for obesity treatments could expand to USD200 billion by 2031, of which USD70 billion could come from new weight-loss drugs challengers (Report by Morningstar and Pitchbook, 09.09.2024). Estimates grew from last year, when analysts expected a market size of only USD170 billion by 2031.

- New challengers include 16 drugs that could launch by 2029, to compete with the major incumbents.

What could be the opportunities for investors?

1. Betting on a basket of individual stocks:

While weight-loss drugs development and commercialization are still in infancy, there are already clear market leaders. Novo Nordisk’s GLP-1 drug, Wegovy, has seen rapid adoption due to its dual benefits in weight reduction and cardiovascular health. And Eli Lilly’s Tirzepatide is also showing promise, with clinical trials indicating superior weight loss outcomes.

In terms of pharmaceutical giants there are also AstraZeneca and Roche which are developing their own drugs. They both rose their profit forecasts for the year amid positive momentum during their latest quarterly earnings announcement.

Smaller healthcare companies have also had success, such as Copenhagen-based Zealand Pharma, which saw its shares rise by more than 130% this year. The company is testing a next-generation weight-loss compound. Or Viking Therapeutics, which made headlines in February when its stock rose 121% in a single day after positive results for its experimental weight-loss drug VK2735.

Other companies such as healthcare distributor McKesson have also benefitted from sales of weight-loss drugs. And, smaller German medical equipment company Gerresheimer, which supplies weight-loss drug makers with autoinjector pens.

Moreover, companies helping patients with cardiovascular issues are also an area to consider. Edwards LiveScience for instance is one of such companies, specializing in artificial hearth valves and blood flow monitoring.

As a caveat, investors need to note that many healthcare companies are racing to develop solutions as the weight-loss drug market is still in its infancy, and thus there is little visibility on how strong competition could be in the future. To select the stocks of companies that should profit most from weight-loss drugs, investors should seek expert insights, and still then, there is a high uncertainty as to which companies will win the most market shares in the end.

2. Betting on the overall healthcare sector globally:

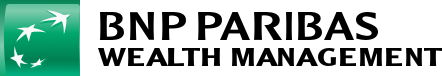

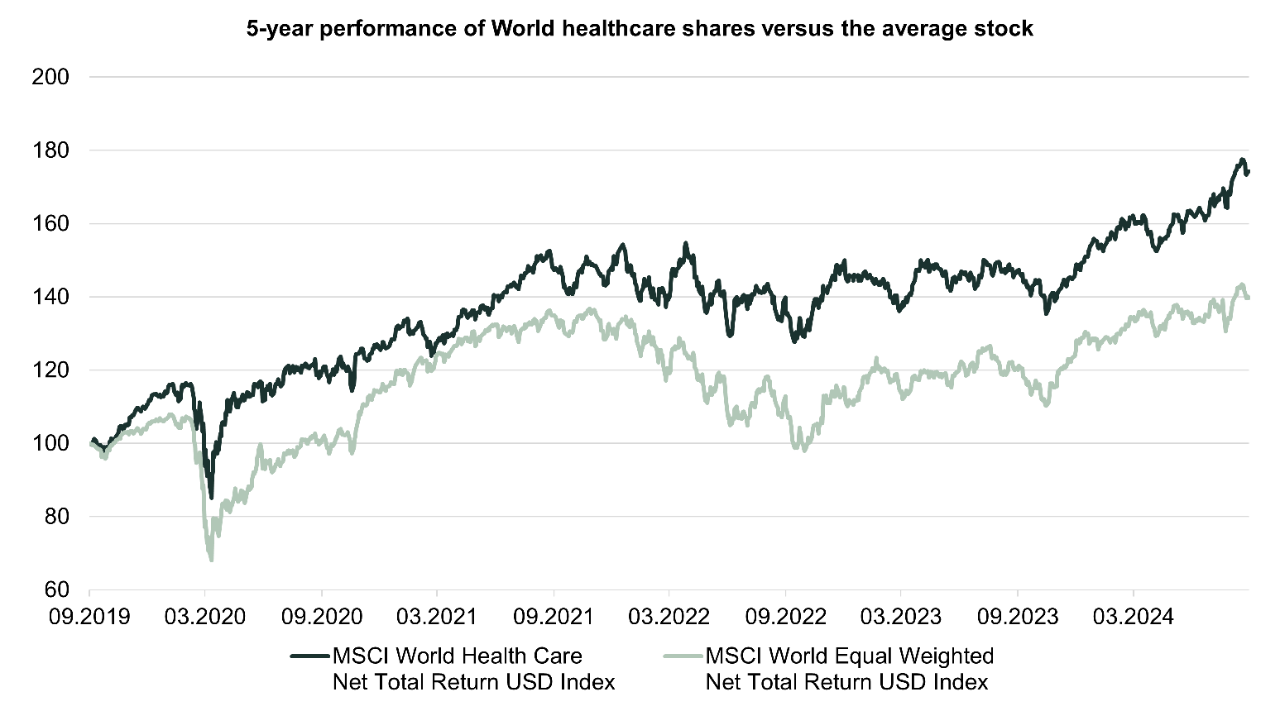

As a more diversified bet investors may explore global healthcare indices, aiming to capture the growth of the overall healthcare industry in the long term. Analysts expect major pharmaceutical companies to target for acquisition the smaller companies specializing in obesity drug treatments, therefore betting on large pharma could also pay off in the long term.

Healthcare has shown resilient performances historically, thanks to its middle ground between being a reasonably defensive sector (biotech aside) as well as offering growth potential. The rapidly rising aging population globally is also a strong push factor supporting growth in the healthcare industry.