Source: Bloomberg data, as 18.09.2024.

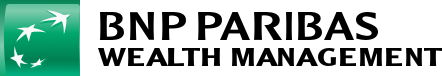

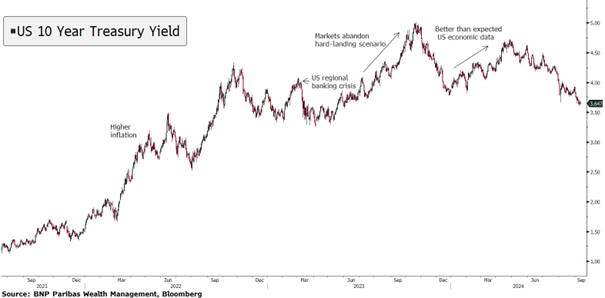

In our view, the Fed will likely opt for a more gradual approach, with only two cuts by the end of the year, with its next moves likely driven by the evolving inflation and unemployment data.

What are the timely opportunities?

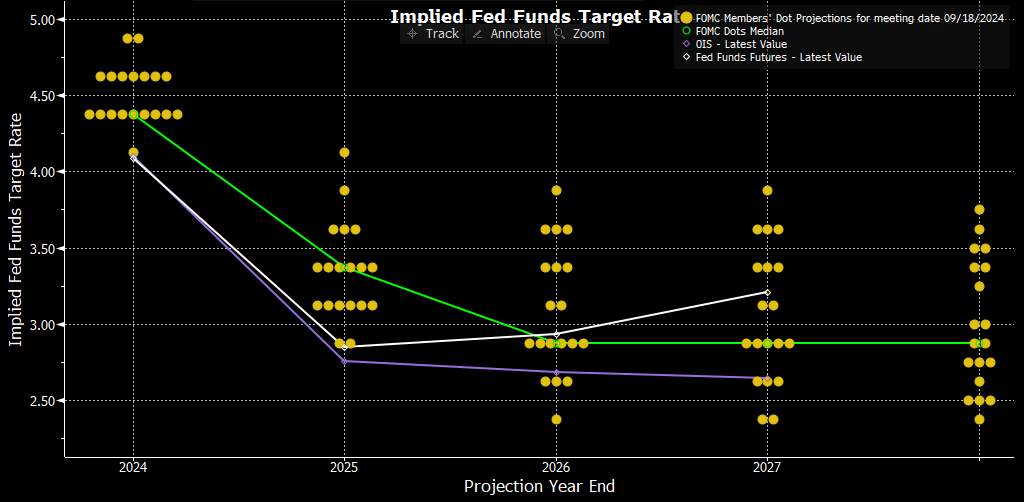

Investors believing in a still robust US economy sailing through 2025, essentially should be in the camp that markets are pricing too many interest rate cuts as these should not be justified if the economy is too hot. In our view there are two angles to take advantage of markets not entirely pricing in this view.

In terms of bonds, investors could essentially position more towards the start of the yield curve and keep some risk in terms of corporate debt.

In equities, the more prudent Fed cuts (slightly negative) could be balanced out with the fact that the economy remains strong (positive). In essence, those stocks which act as bond proxies such as those stable utility names with high dividend yields could be set to lose some of their shine. On the other hand, a more robust economy rather than a recession should be largely positive overall for equity markets globally, particularly those that are more sensitive to the economic cycle.

Structured products could also offer more precise payoffs to capture elements that may not be priced by the markets and to play a distinct market view. It is typically an area that requires distinct expertise and that could be particularly appealing for large investors.

Key risks to consider

Investors should consider that it should depend on the state of the economic activity over the next months, and how excess liquidity is faring. More than economic growth, whether we see a soft landing or if a recession materialises, the market reaction could be more significant on how the Fed’s communication is perceived and if it is enough to reassure investors.

This article is brought to you by the Advisory Solutions Team.

Contributors: Maxime Bonnet - Head of Advisory Solutions, Paul de La Baume - Investment Advisor