Fears over inflation remaining high for longer have rapidly resurfaced being driven by better-than-expected growth forecast globally and particularly in the US, embracing the ‘soft-landing’ scenario.

Why could inflation stay higher for longer?

These are the primary reasons in our view, shaped by government policies:

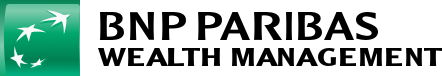

- Loose monetary policy - Low interest rates and quantitative easing prior to 2022 have contributed to a strong economy. Keeping interest rates low for a long time has buoyed prices of real estate and financial assets that has added more fuel to the economy. This wealth effect is still taking place today and is ultimately inflationary.

- Moving Production Domestically

- Re-shoring & Friend shoring, moving chains of production home or to foreign partners due to government economic incentives (i.e. the US’s Chips Act, Inflation Reduction Act etc.) tend to be inflationary. This deglobalisation, also enhanced by geopolitical tensions tend to increase production costs and thus lead to higher inflation.

- Tariffs: The threat of tariffs or actual tariffs or negative consequence from moving production overseas has caused inflation as ultimately the consumer pays the tariffs as businesses are forced to increase their prices.

- Rising Labor Costs - Since the 2020 global pandemic, workers have demanded higher wages to keep up with the cost of living. It has created a self-reinforcing inflationary spiral with business costs rising and in turn prices rising. Companies are quick to agree with labor unions in order to stop worker strikes (Port workers, Boeing, farmers, auto workers etc.)

- Boom of energy demand & need for Energy Transition

- Energy transition efforts are fuelling a boom in critical commodities such as lithium, copper, and rare earth metals. But more recently, the AI revolution and its associated infrastructure being built is creating enormous demand for electricity, pushing up prices.

- AI, data storage and analytics consumes enormous amounts of energy, and it is in fact proving expensive and in turn inflationary.

- Both AI and the energy transition divert key resources from other areas of the economy, adding to possible workers shortage.

- Government support such as subsidies to encourage the energy transition also help fuel demand, adding to inflation.

- In essence, consumers will likely pay for AI-services in their bill, just like smartphones increased the cost of using a phone, by creating a new product many see it then as a new necessity, accepting a larger monthly expense.

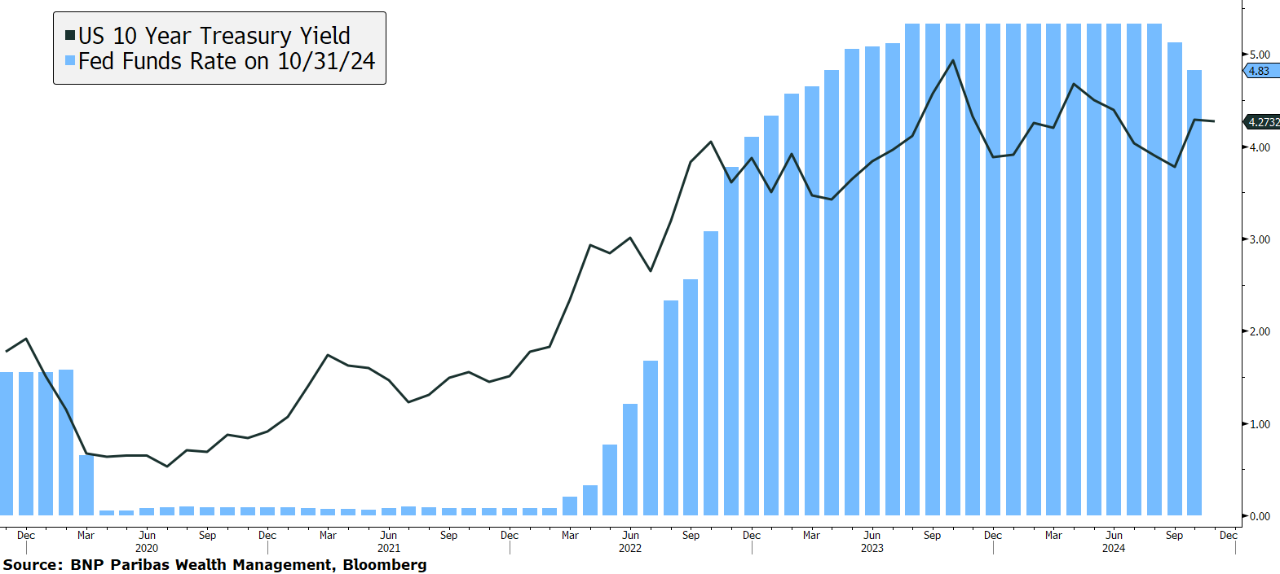

There are historical precedents of multi-year inflationary waves.

Markets strategists are increasingly sharing the view that there are structural drivers that could lead a new inflationary wave. In the example below, Gavekal Research reviews the inflation waves of the 1970s, although today the structural drivers of inflation are somewhat different in nature.