Investors can benefit from ESG added value in different ways, with various financial performance outcomes.

There are several approaches to take into account sustainability challenges in the investment process, for instance:

- Considering ESG (Environmental, Social, Governance) practices of companies to protect and enhance the value of a portfolio over the long term.

It mainly relies on exclusions (removing exposure to controversial sectors such as tobacco, gambling or coal) combined with a best-in-class selection process (selecting instruments with the best sustainability ratings).

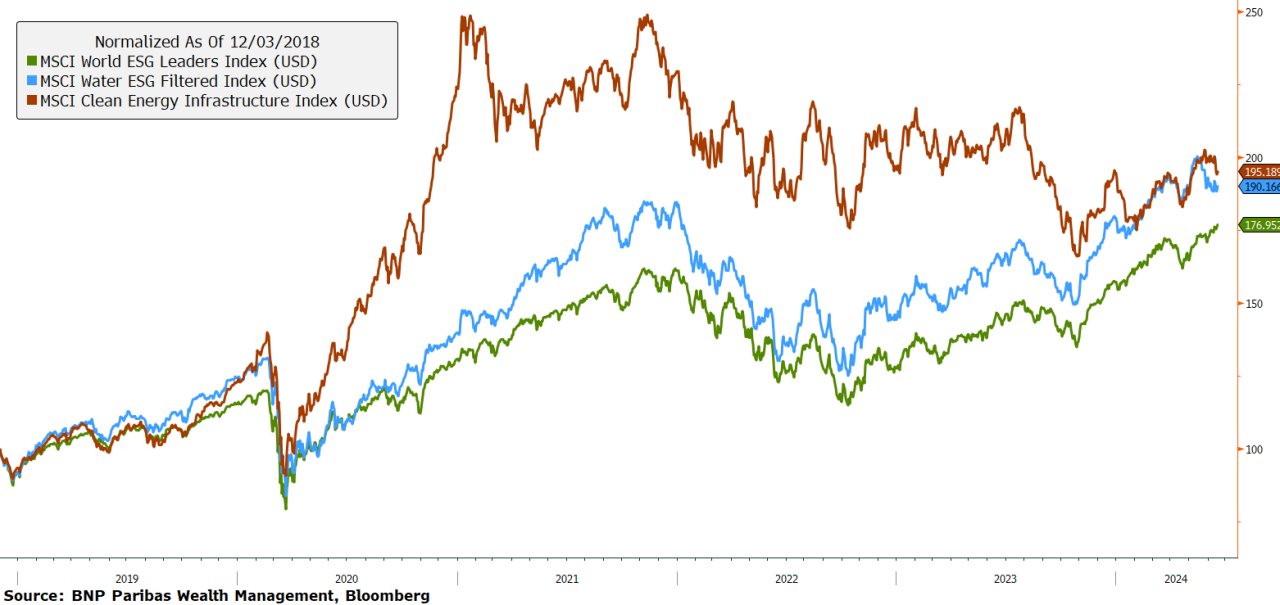

- Investing in specific sustainability-oriented themes

On the top of the selection process described above, thematic investments focus on sectors related to sustainability challenges such as water management or circular economy.

A brief review of ESG performances

Investors have observed different patterns of performance according to the strategy, as illustrated by the examples below.

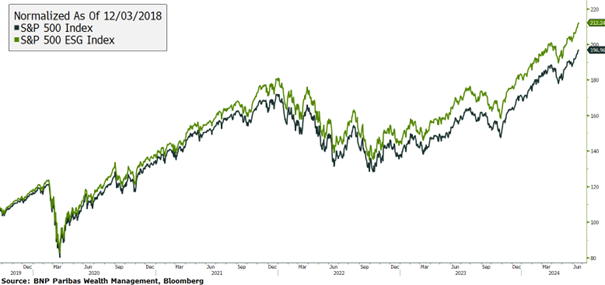

Indexes with ESG factors

One of the most widespread approaches is to include ESG filters in stock market indices via exclusions and a positive screening (best-in-class selection process). In the chart below, we notice a stronger performance in the ESG version of the S&P 500 index compared to the traditional one over the past 5 years.