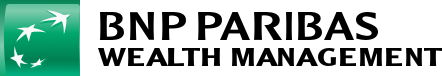

Bloomberg data, As of 17 July 2024

Which stocks should benefit from the rotation?

To capitalize on this shift, consider the following:

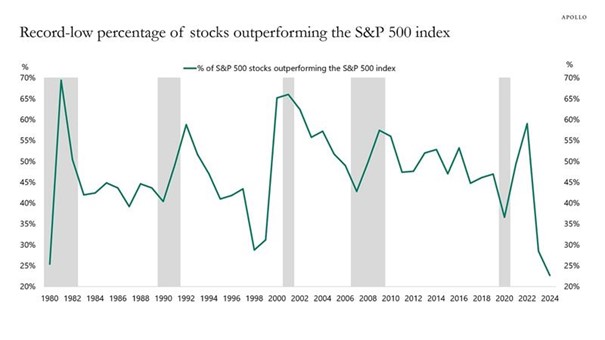

1. Caution on large tech exposure: "Magnificent Seven" stocks have delivered, but they could now be well over-extended, as markets tend to overexaggerate on the upside. Quality stocks have strongly outperformed the rest and valuation may be too steep at current levels. Investors may thus benefit from reducing exposure to reallocate elsewhere with lower valuations.

2. Positive on Defensive Sectors: Healthcare, Consumer staples, and Utilities are your go-to sectors. They offer stability and consistent returns, especially when uncertainty looms. Those sectors can still offer interesting returns and re-rate, with some stocks currently offering interesting risk/reward ratio. Additionally, high dividend stocks might come back into favor and may do so even more in the case of stronger than already priced in interest rate cuts.

3. Stock Picking might be back: Leveraged companies, Value, Cyclicals, Energy Transition stocks… Since 2022, investors were harsh with these companies, offering cheap valuation on a lot of interesting investment cases while indices were on everyone’s mind. Now with cooling US inflation (potential rate cuts looming) this could be the awaited catalyst to enact a re-rating of all these stocks. Stock pickers may now get the chance to outperformed indices again.

4. Compelling valuation for European Small-caps: With interest rates likely to come down, we keep our bullish stance on small-caps to catch up large caps. These companies should thrive in a more favorable economic environment. While US small caps have started to rerate already, European small caps remain very much underappreciated by investors, in our view.

In conclusion, with further signs of inflation being under control, it looks increasingly likely that the US Federal Reserve will proceed with its first interest rate cut. This has triggered in our view what could be the start of a significant market rotation in favor of cheaper segments of the market. We suggest considering rebalancing exposures to cheaper segment of the market that should outperform in the next phase of this cycle, in our view.

This article is brought to you by the Advisory Solutions Team.