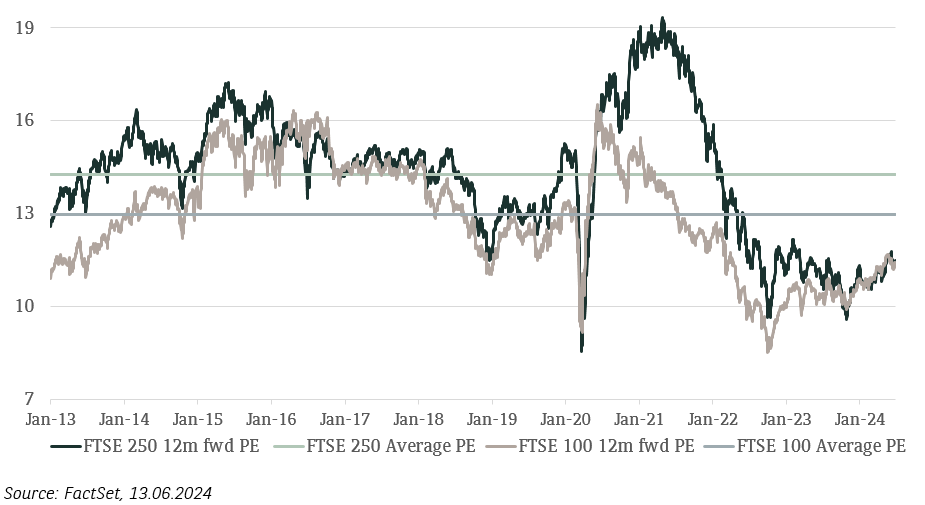

Home to defensive and value stocks with a high sector allocation to mining, banking and consumer staples stocks, the UK stock market has been highly unpopular in the last few years due to the nation’s clouded economic outlook and political woes. As investors commended a higher risk premium to hold UK stocks it has left a valuation gap in comparison to international stocks. Thus, we are now noticing international investors taking interest in UK stocks again, as well some strategic investors attempting to seize mergers and acquisition opportunities (i.e. the offer on Anglo American).

A valuation discount gap set to close?

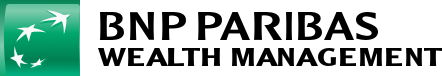

The FTSE 100 index, the benchmark for the largest 100 publicly traded companies in the UK trades near a historic low and lags behind peers. Its price-to-earnings multiple ratio is around 11.9x, which is still way below its historic average of around 13.5x. It makes the index appear cheap, in our view.

FTSE 100 and FTSE 250 indices P/E ratio versus historic average